FAQs: How Bellco will apply loan payments

Bellco will be changing the way we apply payments on certain types of consumer loans (e.g., lines of credit, signature loans, and auto loans). These FAQs are provided to help you understand how these changes will affect your payments moving forward.

For certain loan types (e.g., lines of credit, signature loans and auto loans), when a loan payment is received, funds will be applied to payments due in the order of their due dates, if any, beginning with the oldest due date. If you have missed payments and/or incurred late fees (but your loan has not been charged-off), funds will first be applied to the missed payment with the oldest due date and in the following order: first, to any late fees attributable to that missed/late payment, next to interest due for that missed/late payment, then to principal due for that missed/late payment. After satisfying the missed payment with the oldest due date, any remaining funds will be applied to the missed payment with the next oldest due date in the same fashion, until all the funds have been exhausted.

This process will apply to all loan payments received until all funds are applied as mentioned above and/or the loan is brought current. Once the loan is current (i.e., no payments are currently due and owing), any excess funds will be applied to the principal balance.

You should review your periodic statements. All late fees were reflected on the periodic statement for the month the late fee was assessed. For example, if a late fee was assessed in March, the late fee will appear on your periodic statement for the month of March. Late fee amounts, and when late fees are assessed, vary based on loan type. Please refer to your loan contract, periodic statements, and loan transaction history in Online Banking for further details.

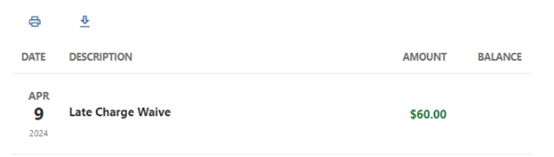

Late fees are separate from the outstanding interest and principal balance of your loan. Late fees do not affect the interest due or the principal balance of your loan. This one-time waiver of late fees will not decrease your principal or interest balances. Waived late fees will no longer be due when you pay off your loan.

Being charged a late fee does not automatically mean the delinquency gets reported to the credit bureaus. Delinquency is only reported to the credit bureaus once your payment is 30 days or more past due.

Please review your credit report to determine if a payment was reported 30 or more days past due. Loans are only reported delinquent to the credit bureaus when the payment is 30 days or more past due. You can obtain a free copy of your credit report from each of the credit bureaus once annually at annualcreditreport.com.

If you are charged a late fee because you didn’t make your current payment timely, and then make only your regular monthly payment of principal and interest for that month, the funds will be applied first to the outstanding late fee, then interest due, and then principal balance. This means that the payment will be “short” for that month since you did not make the full payment due for that month (including the outstanding late fee). Bellco may, at its sole discretion, choose to consider that “short” payment as satisfying the amount due for that month, which means you will not be reported to the credit bureaus for failing to make the full payment due that month.

Please refer to your loan contract to confirm your due date and when and how late fees are assessed. You can also find loan details such as your due date in Online Banking. Please visit www.bellco.org to log in, or visit www.myaccounts.bellco.org/registration to sign up for online banking access.